Budget 2024-2025 Response

St Peters Residents Association Budget Response 2024-25

SPRA have significant concerns about the rise in rate revenue and debt position of the council. SPRA would prefer to see council spending cut or deferred rather than rate rises at more than double the rate of inflation.

History

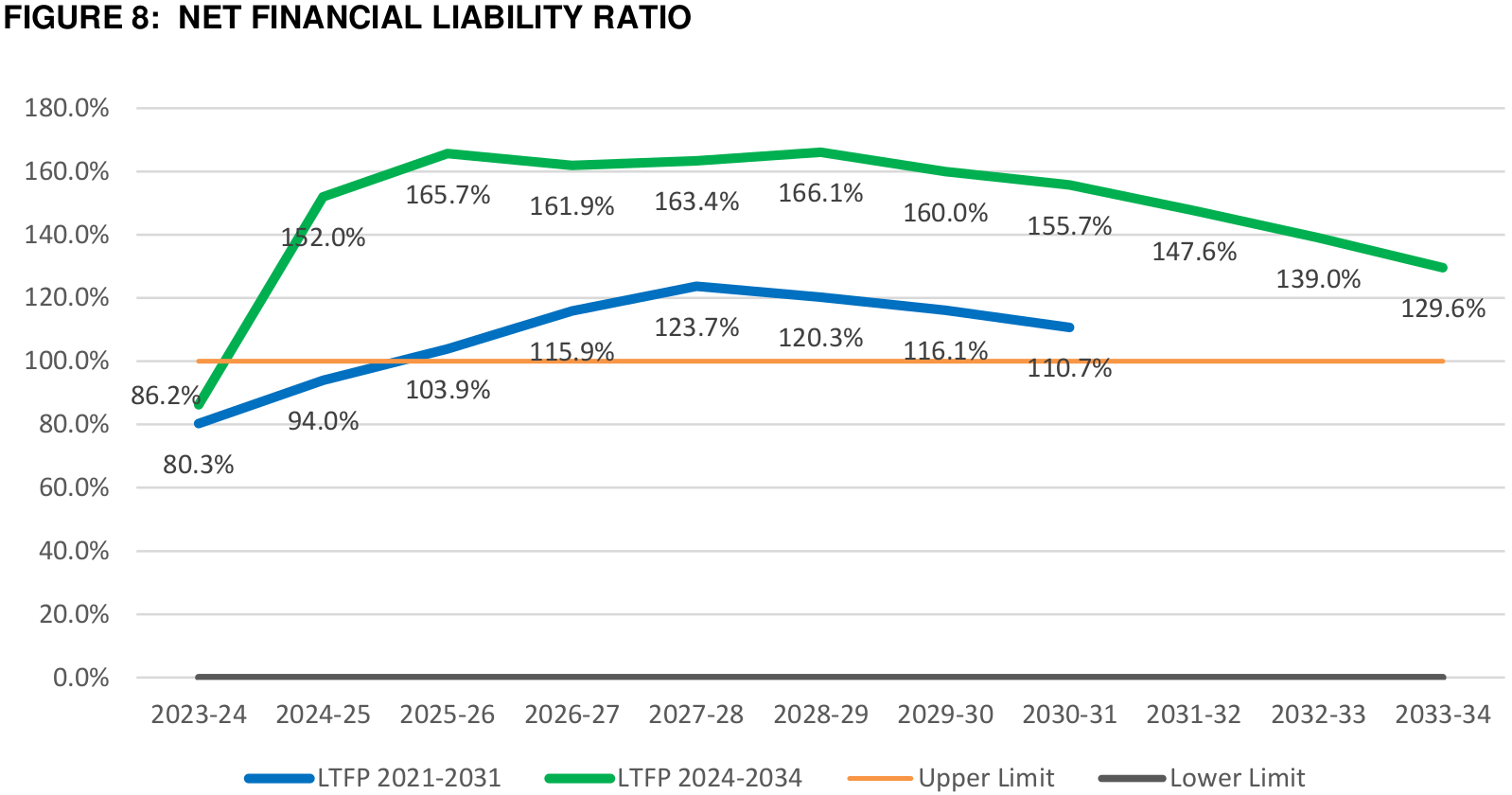

In our response to the draft of the 2023-2024 budget, SPRA noted concerns about the Payneham Memorial Swimming Pool and the significant increase in council debt represented by the Net Financial Liabilities Ratio (NFLR). Twelve months later the budget of the Payneham Memorial Swimming Pool has tripled to $60 million from earlier estimates with the potential to increase further. The NFLR has increased from the previous peak of 117% to 162% and will still be above 130% in 2034.

Traffic Management

SPRA would like to acknowledge the council's action on the safety concerns raised on Richmond St, Hackney. We support the detailed design of a traffic management solution. Has a first order estimate been made for the cost of the changes and has this been included in the long term financial plan?

Traffic, particularly speeding motorists using side streets, is an issue that SPRA receives frequent complaints about. We support councils work on this and in particular look forward to the introduction of 40km/h speed limits.

Long Term Financial Plan

SPRA has a concern that the LTFP 2024-2035 is not being finalised as part of this 2024-25 Annual Business Plan and Budget process, in accordance with Council’s 11 December 2023 resolution1. This makes it difficult to properly comment on some aspects of the draft budget.

The significant amount of debt being taken on by the council makes the LTFP an important component in the analysis of budget. SPRA are unsure where to source the latest version of the LTFP as different numbers exist in the agendas of Meeting of Council and Audit and Risk Committee.

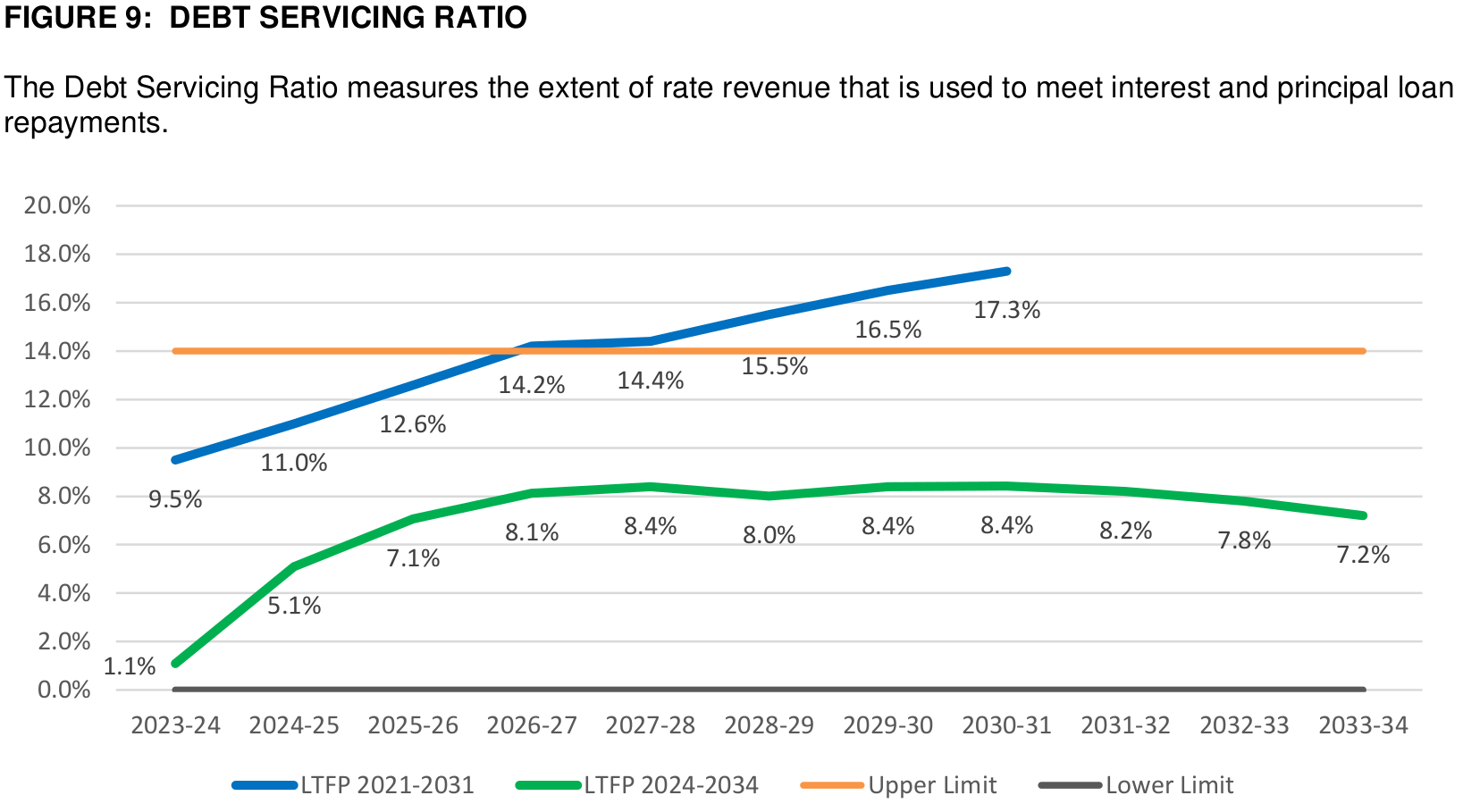

The ‘Debt Servicing Ratio’ is predicted to be between 8%-9% in the 2024-2034 LTFP down from a peak of 17.3% in the 2021-2031 LTFP. How is this possible when ‘Net Financial Liability Ratio’ has increased from a peak of 123.7% to 165.7%?

SPRA understands that the estimates used in the LTFP are first order and will be refined . How much confidence does the council have in the accuracy of these estimates? Has the council modelled the different scenarios for changes in project costs, inflation and interest rates?

Employee Costs

Employee costs are $19.5m which is approaching 20% of operating expenditure. The budget has 176.1 FTE staff, which equates to an average of $110,732.

At the information session, a question was asked about why have Employee costs increased by $2.138 million (12.3%) from this year and $4.954 million (34.0%) in two years since 2022-2023? The answer was given that this was inaccurate due to errors. Could we please have an explanation of the errors and a report with a breakdown of the costs of the senior executive, middle management and staff for the 2024-2025 budget and the previous five years.

Conclusion

Members of the committee took the opportunity to raise other concerns at the public information sessions. We have not again listed them in this response but look forward to receiving answers to those questions in the report that will come to Council when the final budget decisions are made.

SPRA would implore the council to closely examine the submissions by Peter Holmes and Peter Fairlie-Jones as we understand them to have significant professional experience as Independent Members of several Council Audit & Risk Committees.

The St Peters Residents Association trusts that these comments will be considered in the finalisation of the 2024-2025 budget.